Something big is brewing (and not everyone is seeing it)

Bitcoin's price may seem stable to us, but we need to be vigilant, due to the movements taking place in the economic landscape. Few companies were taking the step to hold a percentage of their treasury in BTC but thanks to them, more adoption is increasing: more and more companies are accumulating Bitcoin as a strategic asset.

But why are they doing it, what are they looking for, and who are these new players in the crypto ecosystem?

Why are companies betting on Bitcoin in 2025?

Behind all the companies making Bitcoin purchases: there is strategy, vision, and a profound transformation in how companies manage their reserves.

Jeff Park, manager at Bitwise, states that we are witnessing the birth of new companies: Bitcoin Treasury Companies.

These are the 3 most important reasons why companies decide to add Bitcoin to their treasury:

- Protecting themselves against inflation and the decisions and influences of monetary policies from major institutions.

- An asset without a direct correlation to the traditional financial system to avoid major stock market crashes.

- A strategic long-term investment given the continuous market growth in the coming years.

Real strategies: how companies are using their Bitcoin

Companies are going beyond a simple “buy and hold” transaction; they carry out strategies with their BTC reserves:

- Financing with convertible bonds: like Strategy (formerly MicroStrategy), which issues debt to buy more BTC.

- Active cryptocurrency management: they lend, invest, or structure financial products backed by Bitcoin.

- Operational leverage: companies like Nakamoto integrate the value of BTC into their business model.

Industry estimates point to more than $30 billion being invested in corporate Bitcoin in 2025.

Who is leading the accumulation of Bitcoin

Strategy (formerly MicroStrategy): the pioneer that is no longer alone

Michael Saylor, CEO of Strategy, is no longer alone in this great adoption. In 2025, his company has consolidated a reserve of more than 580,000 BTC. The strategy they carry out has encouraged others to follow this path.

“Bitcoin is our number one strategic asset. It’s our foundation.” — Michael Saylor, Strategy

Metaplanet: the MicroStrategy of Japan

In May 2025, Metaplanet entered the market with a $117 million purchase of BTC, which raised its reserves to 8,888 BTC. It has become the company with the most Bitcoin in Asia.

Méliuz: Brazilian fintech with ambitious plans

Méliuz has officially announced that it will allocate a financing round solely for the purchase of Bitcoin, making headlines in Latin America for increasing adoption in that region. The first Brazilian company to make Bitcoin purchases.

GameStop: from memes to corporate Bitcoin

GameStop also joins adoption, holding more than 4,700 BTC as part of its treasury strategy.

PSG and the sports world join in

Paris Saint-Germain revealed that it has held Bitcoin on its balance sheet since 2024 and also plans to invest in crypto startups.

Beyond the financial sector: governments and new frontiers

Strategic purchasing and increased adoption are reaching major spheres:

- K33: the Norwegian broker launched a strategy to hold BTC as a reserve asset.

- Pakistan: announced the creation of a national Bitcoin reserve.

- JD Vance, U.S. vice president, stated that Bitcoin is a “national strategic priority.”

What can we expect in the coming months?

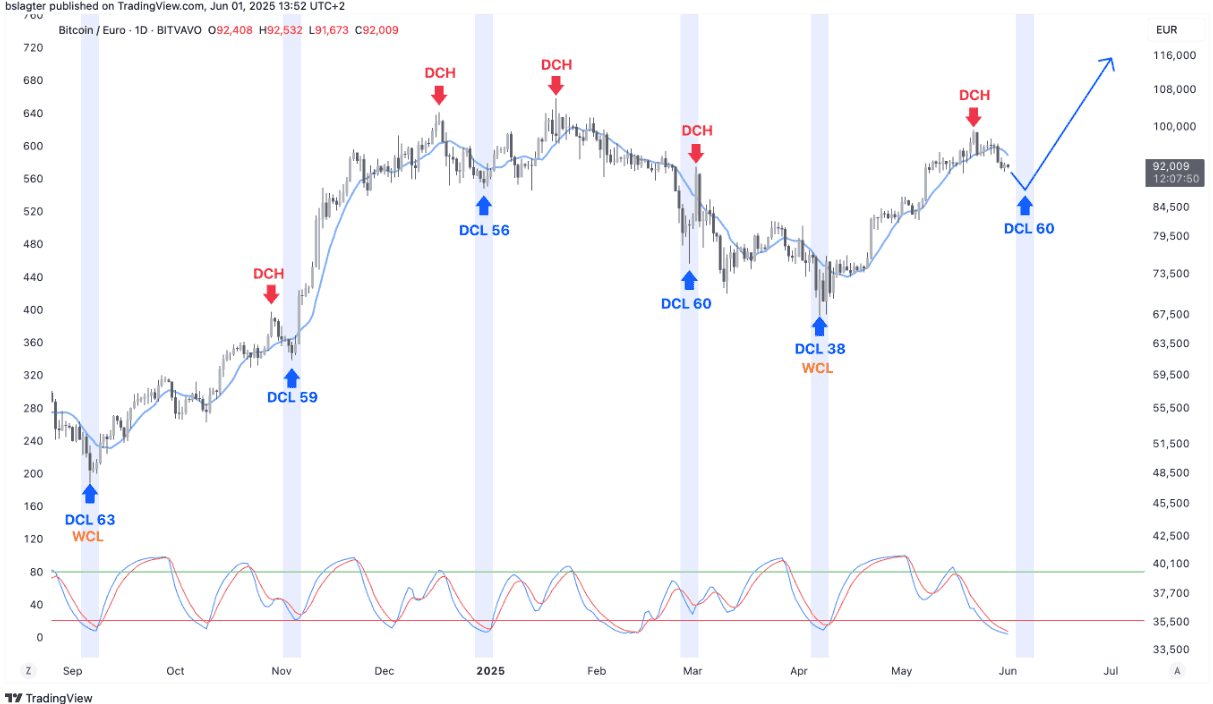

Since April 7, we can observe how Bitcoin begins a new cycle, according to market cycle analysis. If the historical pattern is fulfilled, the second cycle should be bullish, which means we could see new all-time highs.

Relevant technical fact: This analysis does not predict prices, but it does help identify key entry and exit moments when combined with traditional technical analysis.

And you? Are you seeing the same as the big companies?

The question is no longer whether Bitcoin will be part of the economic system of the future, but who is preparing today to lead that change. Companies not only buy Bitcoin: they integrate it, turn it into a competitive advantage, and see it as a tool of financial power. If you make an active Bitcoin purchase and want to know how to declare, here you can see it.