24 days ago

Fed Rate Decision: Could a Surprise Cut Boost Bitcoin to $140K?

Traders await the FOMC announcement to see if an unexpected rate cut sparks a Bitcoin rally to $140K.

Token Price

$115,248.69

Change 24H %

-1.45%

Price Max 24H

$117,030.00

Price Min 24H

$114,560.00

Have you ever wondered why Bitcoin remains the most valuable cryptocurrency on the market despite being over a decade old? This digital asset not only transformed the way we understand money but also created an entire parallel economic ecosystem that continues to challenge traditional financial institutions.

Bitcoin was born in 2009, during the height of the global financial crisis, as a response to a centralized banking system that had failed. Its creator, known under the pseudonym Satoshi Nakamoto, designed it as a peer-to-peer electronic cash system that eliminated the need for intermediaries.

What’s fascinating is that, to this day, no one knows for sure who Satoshi Nakamoto really is. Some researchers point to programmers like Nick Szabo or the late Hal Finney, but the true identity of the creator remains one of the biggest mysteries in the tech world.

"Bitcoin is fundamentally a technological advancement that allows people to exchange value without intermediaries for the first time in human history."

— Andreas Antonopoulos, Bitcoin expert

Bitcoin is much more than just a digital currency. It is simultaneously a protocol, a network, and a digital asset:

What makes Bitcoin unique is its ability to function without a central authority. There is no bank, government, or institution controlling the system. Instead, the network operates through thousands of distributed nodes around the world, each maintaining identical copies of the blockchain—ensuring transparency and resistance to censorship.

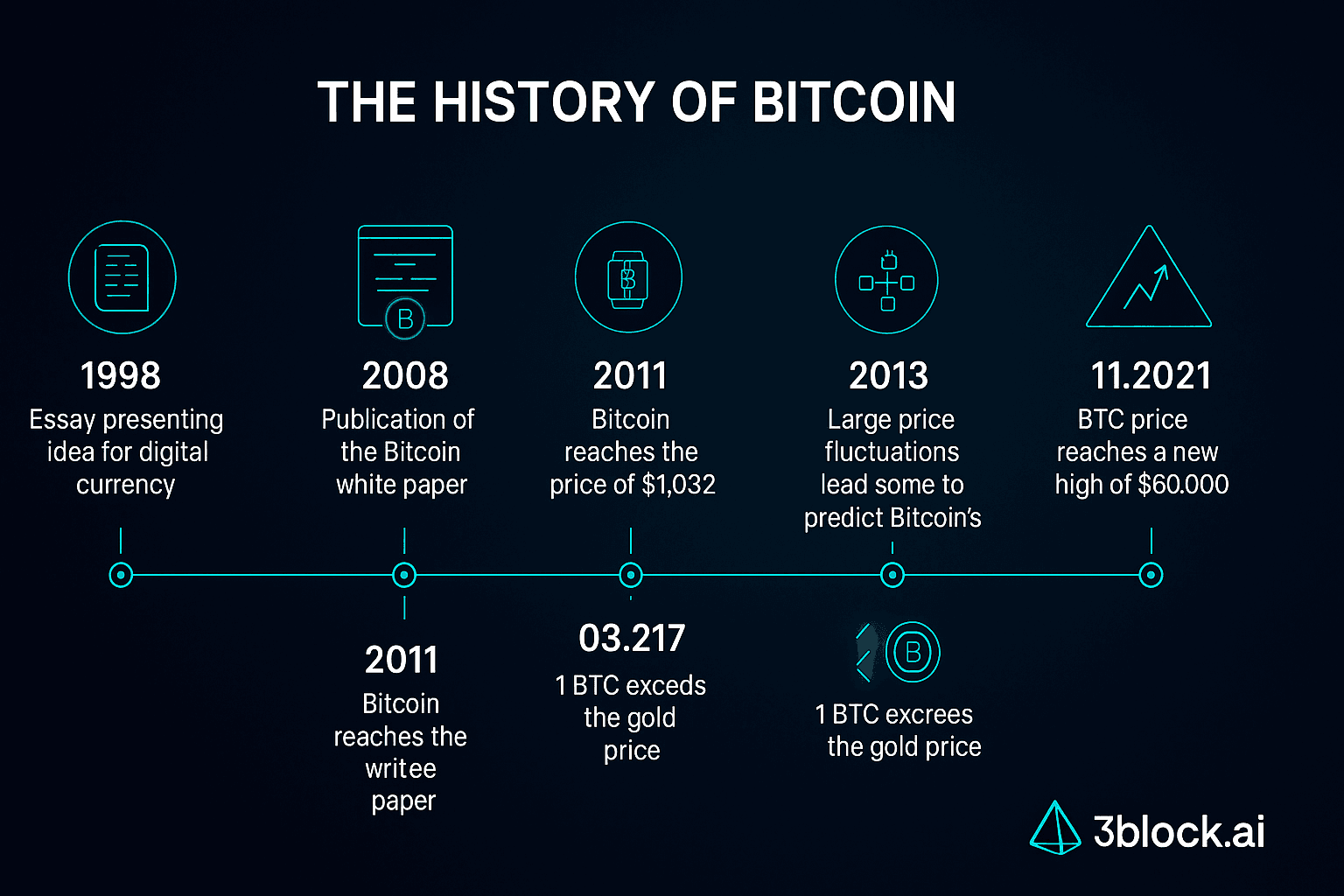

On October 31, 2008, a document titled “Bitcoin: A Peer-to-Peer Electronic Cash System” appeared on a cryptography mailing list, signed by Satoshi Nakamoto. This whitepaper detailed how the Bitcoin system would work, and just two months later, on January 3, 2009, the first block of the chain (known as the genesis block) was mined.

The significance of the creator’s anonymity should not be underestimated. By remaining in the shadows, Nakamoto ensured that Bitcoin became a truly decentralized project, without a central figure who could be pressured by authorities or private interests.

Nakamoto remained active in the development of the project until mid-2010, when control of the source code was handed over and Nakamoto disappeared from the public scene. By then, Bitcoin had already begun its journey toward the financial revolution we are witnessing today.

Imagine Bitcoin as a massive public ledger where every transaction is recorded. This ledger—called the blockchain—is stored simultaneously on thousands of computers around the world, making it nearly impossible to tamper with.

This system prevents double-spending (spending the same bitcoin twice) and ensures that transactions cannot be forged, since any attempt to alter data would be rejected by the majority of nodes in the network.

One of Bitcoin’s most fundamental features is its limited supply. Unlike traditional money, which central banks can print endlessly:

This programmed scarcity is exactly what many investors see as Bitcoin’s greatest appeal—as a store of value that resists inflation, unlike fiat currencies which can be printed indefinitely.

“Bitcoin isn’t just digital money; it’s a monetary system with a fixed supply that ensures it cannot be artificially inflated by any authority.”

— Michael Saylor, CEO of MicroStrategy

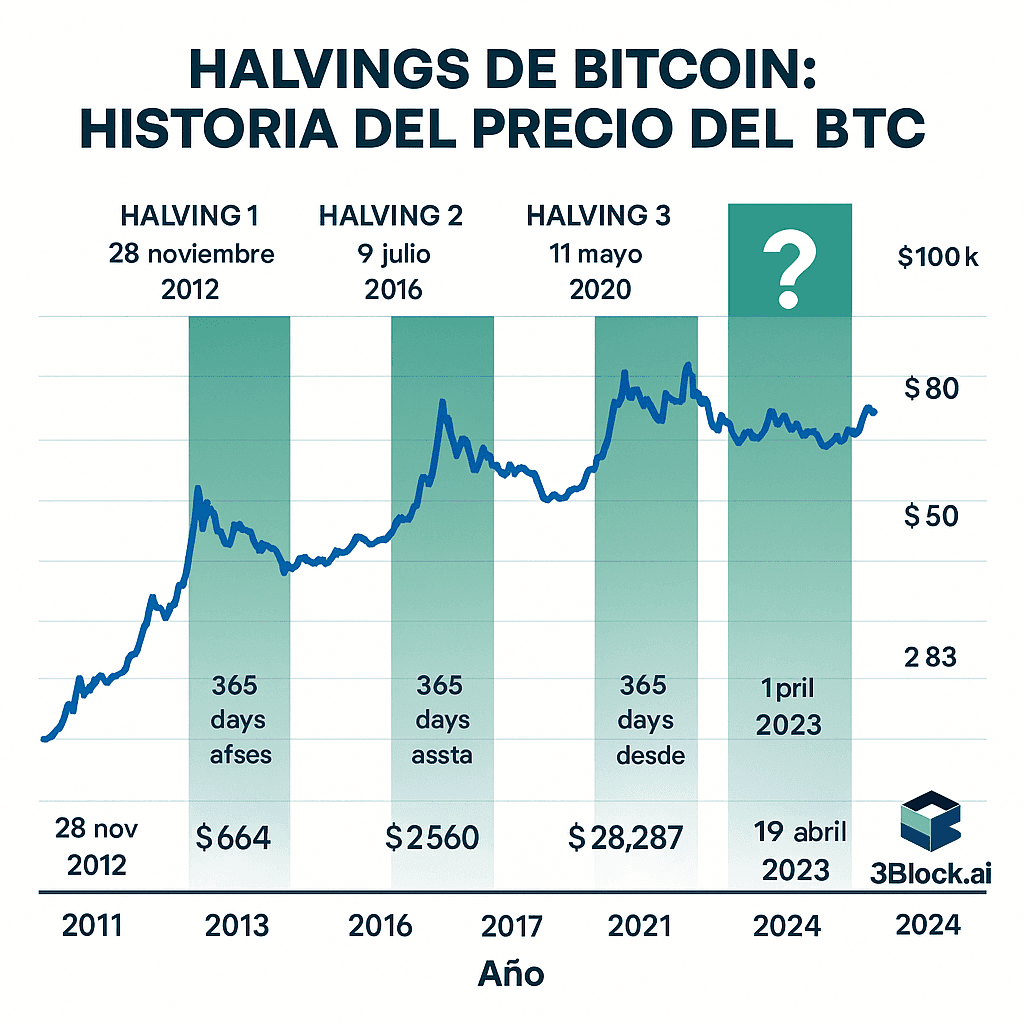

The halving is one of the most important events in the Bitcoin ecosystem. It involves cutting in half the reward miners receive for validating transactions.

The fourth Bitcoin halving took place in April 2024, reducing the block reward to 3.125 BTC. This event, which occurs approximately every four years, is a core element of Bitcoin’s deflationary design.

The next halving is expected in 2028, although the exact date depends on how quickly blocks are mined.

Historically, halvings have been followed by significant increases in Bitcoin’s price—although the effect has lessened over time due to the market’s growing maturity.

Bitcoin mining has evolved significantly since its early days:

“Bitcoin mining is one of the few use cases where energy consumption is directly linked to the security of a global financial network.”

— Nic Carter, Partner at Castle Island Ventures

Bitcoin has come a long way since its creation. Once seen as a fringe technological experiment, it is now recognized as a global financial asset and a store of value.

Its price reached all-time highs above $108,000 in December 2024, highlighting its growing acceptance in the global market. Financial institutions that once dismissed it now offer Bitcoin-related services, and some countries have even adopted it as legal tender.

However, challenges remain. Price volatility, regulatory concerns, and environmental impact debates continue to be hot topics in the global financial community.

Despite these issues, Bitcoin has proven its resilience and adaptability, maintaining its position as the leading cryptocurrency by market capitalization, and the benchmark against which all other digital currencies are measured.

Bitcoin represents far more than just a technological innovation—it is a revolution in how we understand money and value. By offering a decentralized alternative to traditional financial systems, it has opened the door to a new economic paradigm where individuals have greater control over their own assets.

Whether as a means of payment, a store of value, or simply a fascinating exploration of blockchain technology’s potential, Bitcoin continues to challenge expectations and redefine what is possible in the digital financial world.

The revolution that the mysterious Satoshi Nakamoto set in motion back in 2009 is still alive and evolving—reminding us that sometimes, the most disruptive ideas come from the most unexpected places.