Last week we saw positive growth in cryptocurrencies, but with the Middle East gerras slowed this momentum. Bitcoin and Ether pulled back, while oil and gold rose strongly. In parallel, large companies such as Amazon and Walmart are reportedly organizing plans to create their own stablecoins.

Initial market movements

As soon as the week began, Bitcoin was already over €96,000, Ether reached levels not seen since February 24, touching €2,500 on Wednesday. Memecoins have quite a lot of momentum and the general sentiment was positive. However, as the week wore on, the crypto outlook turned dark.

The shadow of the Middle East

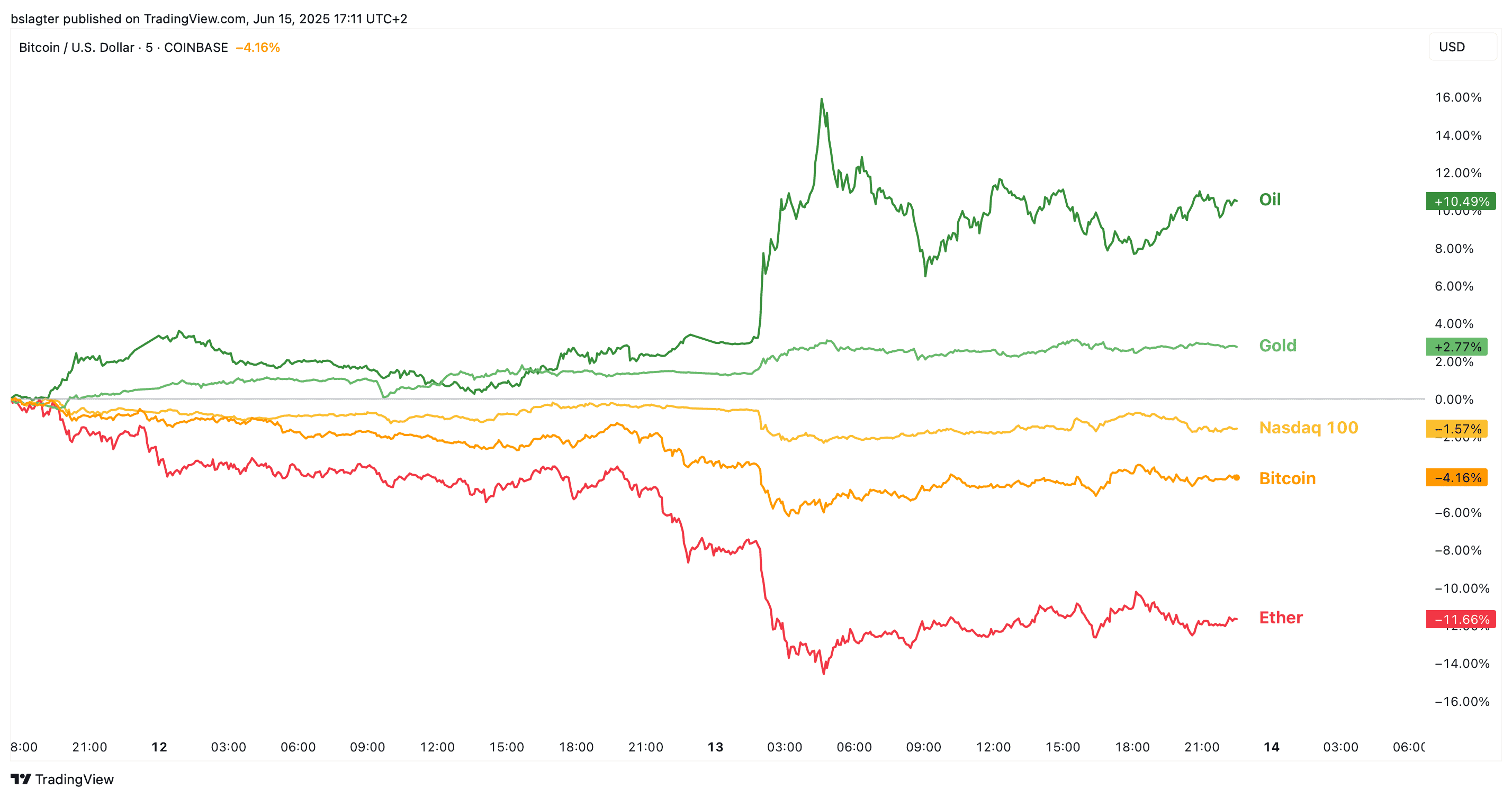

The Middle East, an important region for all those commodities and oil and gas productions, transfers a nervousness to all major markets. The price of oil and gold as of Friday soared, while assets like Bitcoin had fallen 5% and Ether lost more than 10%.

The turning point?

This week, developments in the Middle East will be decisive for markets. If the tension subsides, we could see a rally in Bitcoin and Ether, but it remains uncertain at what point (or if) it will happen.

Is AmazonCoin on the horizon?

On Tuesday, June 17, the U.S. Senate will vote on the GENIUS Act, an initiative that regulates cryptocurrency stablecoins backed by dollar reserves issued by private entities. This payment system control will be shifted from traditional banks to giants such as Amazon or Walmart.

The dollar according to Walmart

According to The Wall Street Journal, Amazon, Walmart and Expedia are designing their own stablecoins, with the aim of facilitating immediate digital payments both in physical stores and online. This motive has arisen due to networks like Visa and Mastercard that have high fees and transfer processes that take days. This will end, companies with global operations will already have it more accessible and easier, avoiding long delays and high costs.

The era of corporate currency

Walmart tried to launch its own currency in the 2000s, but political pressure prevented it from doing so. Today stablecoins do not have so much bureaucracy, they only require a regulatory framework, something that the GENIUS Act seems ready to offer: requirements on reserves, supervision and licensing. If all goes well, we could see stablecoins become part of our daily lives.

Other ecosystem news

Regulatory exemption for DeFi

At a roundtable, SEC Chairman Paul Atkins suggested a possible temporary “innovation exemption” for DeFi projects, prompting tokens such as Aave and Uniswap. If approved, certain protocols could operate without the usual regulation until the standard is defined.

Institutional centralization of Bitcoin

A report by Gemini and Glassnode reveals that approximately 31% of all BTC is held by entities such as governments, exchanges, ETFs and enterprises, totaling more than 6 million coins. This signals a growing market maturity, but also reignites the debate about how decentralized Bitcoin remains.

False adoption in Paraguay

For a few hours, it was spread that Paraguay would have approved bitcoin as legal tender, emulating El Salvador. The alleged statement came from a hack of President Santiago Peña's account and was quickly denied by the government.

BlackRock and the future of cryptos

Rob Goldstein, COO of BlackRock, stated at Coinbase State of Crypto Summit that stablecoins have enormous potential and that its IBIT product seeks to serve as a bridge for investors who shy away from buying BTC outright. He stated that financial tokenization is just getting started.