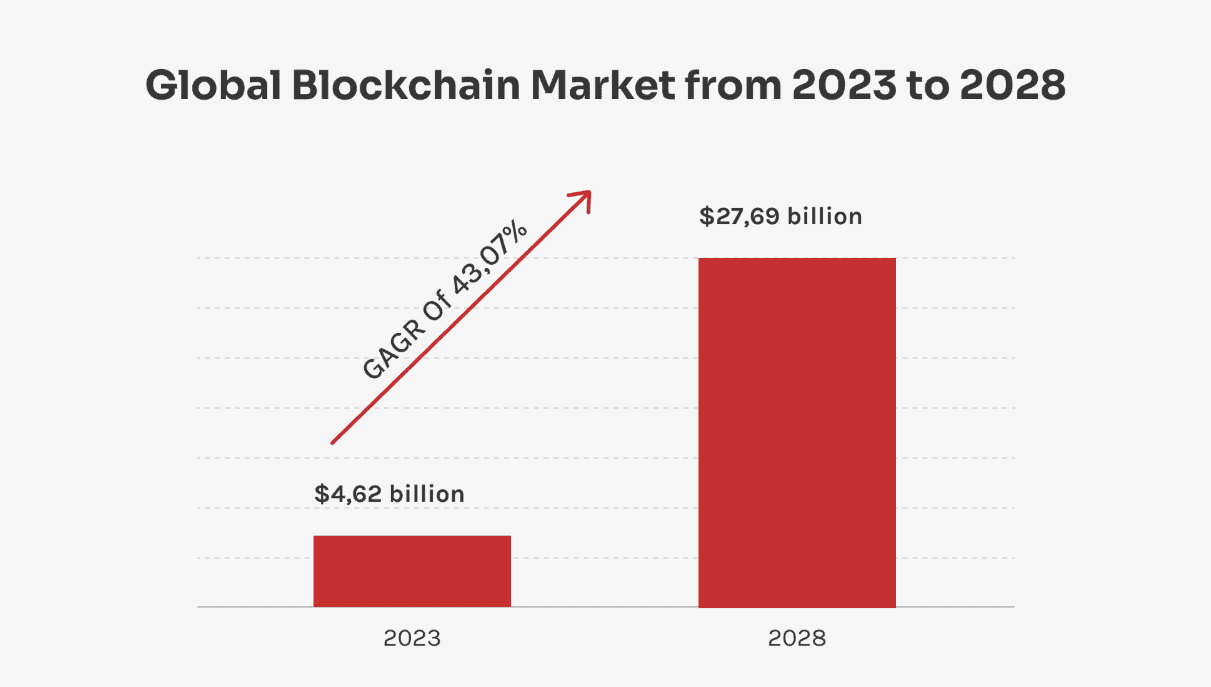

Blockchain technology is changing the game as we have known it for many years in traditional banking, which is gradually falling behind. With blockchain, you will have the opportunity to send money anywhere without intermediary banks and with minimal costs. The mother cryptocurrency, Bitcoin, has brought about this adoption, with large financial institutions and companies beginning to use this technology, redefining the entire traditional financial ecosystem.

The new era of decentralized finance

What advantages does blockchain offer in the financial sector?

The technology itself offers much more than what we understand as cryptocurrency. Let's appreciate that it can create networks of trust distributed throughout the world, bypassing traditional intermediaries such as banks and providing access to direct, fast, and inexpensive financial transactions.

Blockchain technology strengthens relationships in all sectors, as everything is recorded on the blockchain without the possibility of altering anything. This means you can trust the integrity of every transaction, whereas in traditional banking you have to place your trust in them without knowing what they are doing with your money.

In addition to the benefits of security and transparency, we can also include the immediate elimination of friction, delays, high costs, and increased operational efficiency across the sector, including global trade, trade finance, clearing, and settlement, according to IBM experts.

Revolutionizing international transactions

Traditionally, when transferring money between countries, traditional banks require several days to complete the payment and also charge high fees for each intermediary involved in the transaction.

Blockchain completely changes this landscape, as transactions will be made immediately, completely eliminating the need to use multiple intermediaries. This streamlines the process for companies, institutions, families, and others that operate globally.

Success stories of banks adopting blockchain

Ripple and American Express: unprecedented speed

The partnership between Ripple and American Express brings even more adoption to the potential of blockchain. American Express's payment service now uses the Ripple network, providing a better experience for customers. Traditionally, transactions took days to complete, but now they take seconds.

This partnership not only improves speed, but also increases transparency. Customers can track their transactions in real time, eliminating the uncertainty typical of traditional international transfers.

Let's not just focus on the speed of making a transfer, but also on another advantage: transparency. Customers can view the record of all transactions in real time, completely eliminating the uncertainty of having to use multiple intermediaries.

JPMorgan and its digital currency JPM Coin

JPMorgan Chase has developed JPM Coin, a digital token backed by US dollars that operates within its private blockchain ecosystem. The goal is immediate transactions and liquidity management every day of the year, 24 hours a day.

This technology continues to demonstrate its great potential in any sector, with no associated costs and recording of all movements and transactions in seconds. It is not only used in the financial sector but also in education and voting systems. It is clear that financial institutions can gain advantages by implementing blockchain.

HSBC: digitizing trade finance

HSBC has also taken the plunge by directly implementing the technology in its trade finance operations, reducing document processing from one week to a single day. This improvement was demonstrated in a real transaction between ArcelorMittal Nippon Steel India and Universal Tube and Plastic Industries in the United Arab Emirates.

Security and transparency: the pillars of the system

How does blockchain technology improve the integrity of financial transactions?

Blockchain security works very differently from traditional systems, as it does not rely on a single institution or body. Blockchain uses advanced cryptography and data distribution to make it impossible to hack or manipulate.

Every movement within the network is permanently recorded so that all participants can see it, which means that any attempt at fraud or modification will be immediately detected and rejected by the system.

Because the transmitted data is intrinsically encrypted, it is much more secure than the standard password and username system, according to cybersecurity experts.

Intelligent automation with smart contracts

Smart contracts are another advantage of blockchain, as they are executed automatically and do not need to be supervised by anyone or anything, reducing errors and speeding up processes.

There are many sectors in which smart contracts can streamline all documentation management processes. For example, in the insurance sector when making claims. When the conditions of the smart contract are met, payment is made automatically without human supervision.

Financial inclusion: democratizing access

Use cases for blockchain in financial services

Blockchain reduces many bureaucratic processes, making it more accessible to anyone from any country. This democratization is especially important in developing countries where millions of people lack access to basic banking services.

You can create digital wallets from any device without having to obtain documentation and go to branches... just from there and with an internet connection, you can make payments immediately.

Simplified identity verification

This not only speeds up the account opening process, but also significantly reduces administrative costs for financial institutions.

In KYC (Know Your Customer) processes, you always need documents and other paperwork, but with blockchain, this is not necessary and it is just as secure, if not more so. This speeds up the account process and reduces administrative costs for financial institutions.

The future of blockchain finance

What are the benefits of blockchain in banking and finance?

The main benefits include:

- Cost reduction: Elimination of intermediaries and automation of processes

- Increased speed: Real-time transactions 24 hours a day

- Total transparency: Immutable and verifiable record of all transactions

- Enhanced security: Advanced cryptography and decentralization

- Global accessibility: Financial services without geographical barriers

Challenges and opportunities

Although blockchain has great advantages, governments are beginning to implement bureaucratic regulations to balance innovation and protect the end customer.

Blockchain has great benefits for capital markets, allowing complete and immutable data to be shared, creating a more transparent, liquid, and easy-to-monitor market, according to the Inter-American Development Bank.

Transformation in Action:

The blockchain revolution in finance is not a promise for the future: it is happening right now. From Santander operating international transfers based on blockchain to central banks exploring digital currencies, the transformation is evident and accelerating. For individuals and businesses, this means access to more efficient, affordable, and secure financial services. For the global financial system, it represents an opportunity to create a more inclusive and resilient infrastructure.